Deep fall: from growth to insolvency

Just a few years ago, KTM had ambitious expansion plans. However, 2023 marked a turning point: the group began to stumble, reported that it was hardly selling any motorcycles, had to file for insolvency protection and was faced with a huge mountain of debt amounting to billions. Unsold goods piled up in the yards, while at the same time control of MV Agusta, which had been acquired in 2022, was relinquished. There was also a massive wave of redundancies.

A ray of hope appeared at the beginning of 2024 with the entry of Bajaj as an investment partner. Production was resumed in March, having previously been halted in November 2023. However, just a few weeks later, the plant had to stop production again.

Power struggle at management level

The tense situation is also reflected in the management conflict. An open power struggle has broken out between Stefan Pierer, CEO of Pierer Mobility AG (the parent company of KTM), and the entrepreneur Stephan Zöchling. Zöchling, who among other things is co-owner of the automotive supplier Remus, had granted Pierer a loan of around 80 million euros (€) (around 86 million dollars). He is now demanding immediate repayment, while Pierer believes the due date is June 2025.

In order to enforce his claim, Zöchling wants to sell the shares pledged to him. Such a move could put massive pressure on the share price and fundamentally change the ownership structure of the company.

BRP as a possible savior – but only at a bargain price?

In this economically and politically unstable environment, a potential new player is now emerging: BRP. According to information from the Italian portal GPOne, the Canadian group, which includes Rotax – a long-standing engine partner of KTM – is said to be interested in getting involved. However, it is said that this would only be in the event of a “fire-sale”, i.e. a takeover at significantly reduced conditions following a possible collapse of the company.

According to GPOne, however, BRP is not the only interested party: international investment firms such as Apollo and BlackRock are also said to be in talks with Citigroup, which has been looking for new investors for KTM for around six months.

BRP did not officially comment on the situation: “Our organization is always on the lookout for opportunities for long-term profitable growth. In addition to organic growth, we also regularly evaluate potential takeovers. We do not comment on rumors or speculation,” the company stated on request.

Strategic synergies and old connections

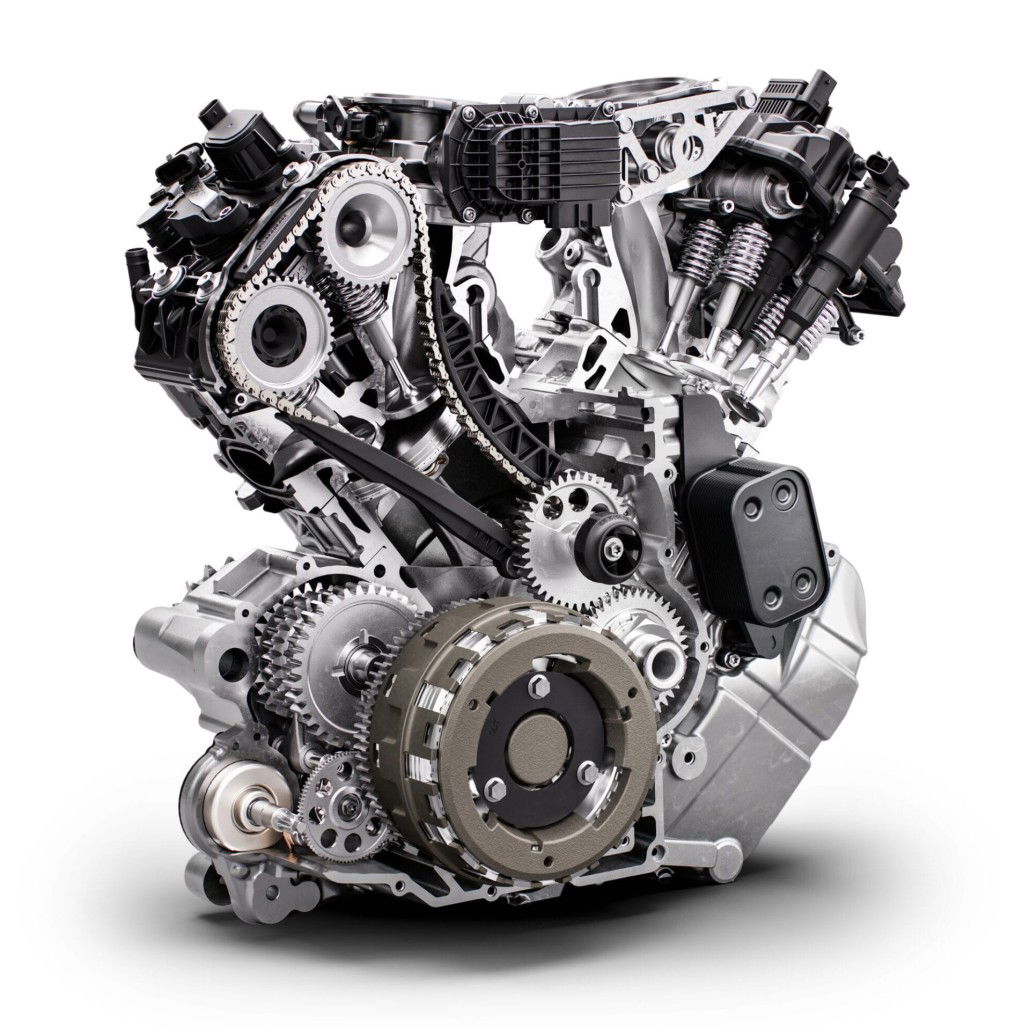

A purchase by BRP would by no means be out of the question. The synergies would be obvious: With Rotax, BRP already owns an important engine supplier of KTM, and the product portfolio – especially in the powersports sector – complements each other on both sides. In addition, a takeover could provide the ailing Austrian manufacturer with much-needed stability and access to new markets.

Outlook: A new beginning or a slow end?

Whether KTM will survive in its current form seems increasingly uncertain. However, industry observers assume that the brand will not disappear completely from the scene – its level of recognition is too high and its technological expertise too significant. However, it is possible that it will only be saved in part or that it will make a fresh start under new management and structure.

The coming weeks could be decisive: If new investors can be found and the internal power struggle defused, there is a chance of a controlled restructuring. However, should a forced sale take place, BRP could emerge from the shadows as the beneficiary – with a low price but great ambitions.